CHARTER COMMUNICATIONS, INC. /MO/ (CHTR)·Q4 2025 Earnings Summary

Charter Q4 2025: EPS Miss Overshadows Mobile Growth as Stock Rallies on Video Turnaround

January 30, 2026 · by Fintool AI Agent

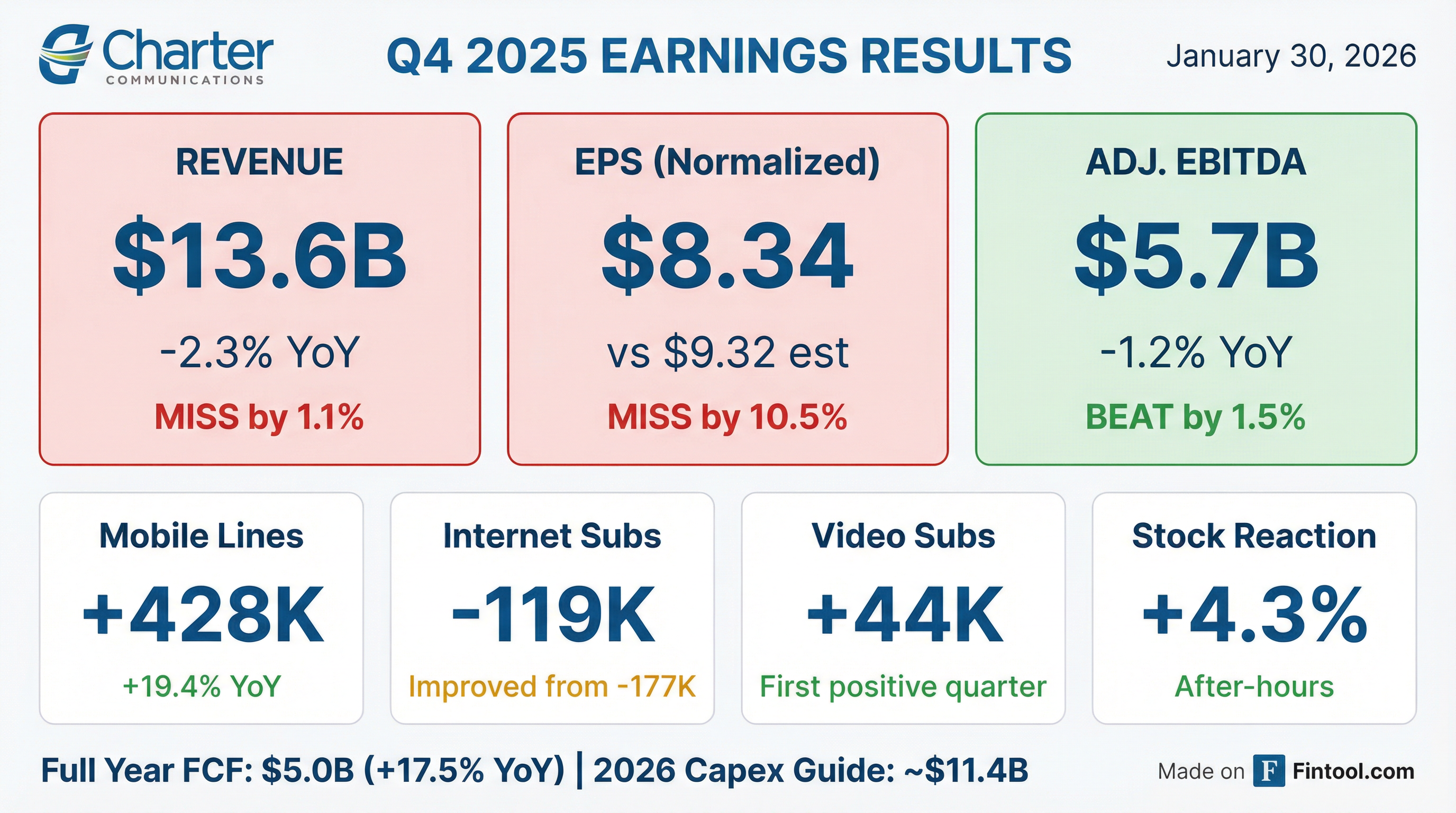

Charter Communications (CHTR) reported Q4 2025 results that missed Street expectations on revenue and EPS, but investors looked past the headline numbers to focus on improving operational trends. The stock rose 4.3% in after-hours trading to $199.81 on the back of the first video subscriber gain in years and continued mobile momentum.

Key takeaways: Internet subscriber losses are stabilizing, mobile is scaling rapidly toward profitability, and the video business is showing signs of life after years of cord-cutting pressure. Full-year free cash flow hit $5 billion, up 17.5% YoY despite elevated capex.

Did Charter Beat Earnings?

No. Charter missed on both revenue and earnings, though Adjusted EBITDA narrowly beat expectations:

*Values retrieved from S&P Global

Revenue declined 2.3% YoY to $13.6 billion, driven by lower residential video revenue (-10.3% YoY) and lower political advertising sales (-25.8% YoY) following the 2024 election cycle.

The EPS miss was larger than the revenue shortfall suggests due to $93 million in merger and acquisition costs related to the pending Cox transaction, along with higher income tax expense.

On a GAAP basis, basic EPS was $10.47, actually up 1.5% from $10.32 in Q4 2024, as share buybacks reduced the weighted average share count by 10.5% YoY.

What Changed From Last Quarter?

Several notable inflections in Q4 2025:

1. Video subscribers turned positive for the first time in years

Charter added 44,000 video customers in Q4, compared to losing 123,000 in Q4 2024 and 70,000 in Q3 2025. This reversal stems from new simplified pricing launched in September 2024 and the inclusion of programmers' streaming apps (Disney+, Hulu, HBO Max, Paramount+, Peacock, etc.) in Spectrum's expanded basic packages—now delivering ~$129/month in retail streaming value at no extra cost.

2. Internet losses improved sequentially

Lost 119,000 internet subs vs. 109,000 in Q3 2025 and 177,000 in Q4 2024. The ACP headwind from mid-2024 is fully lapped.

3. Mobile growth remained robust

Added 428,000 mobile lines vs. 482,000 in Q3 2025 and 522,000 in Q4 2024. Total mobile lines reached 11.8 million, up 19.4% YoY.

4. Cost discipline improved margins

Operating expenses declined 3.1% YoY despite revenue down only 2.3%, expanding Adjusted EBITDA margin to 41.8% from 41.4%.

Key Financial Trends (8 Quarters)

Segment Performance

Charter's revenue transformation from legacy video to connectivity continues:

Connectivity revenue (Internet + Mobile) grew 2.3% YoY to $6.87 billion, now representing over 50% of residential revenue.

Video revenue decline accelerated due to: (1) mix shift to lower-priced packages, (2) fewer video customers, and (3) $165M of streaming app costs netted against video revenue vs. $37M last year.

Customer Metrics

Charter revised its customer relationship statistics in Q4 2025 to include all mobile customers (including mobile-only), better reflecting its converged business model.

What Did Management Say?

CEO Chris Winfrey emphasized Charter's competitive positioning and the "game of inches" required to return to broadband growth:

"Winning connectivity relationships in a cyclical and newly competitive environment is a game of inches. I'm not projecting broadband relationship growth this year, but we expect to see an improved trajectory from the investments we've made over the past three years."

On the video business turnaround, Winfrey was clear that subscriber gains aren't the goal—broadband retention is:

"Our North Star here, our goal is not to have net gain of video just for net gain's sake. Our goal is to have a video product that supports broadband acquisition and broadband retention... When you're on the edge, and you have a high amount of gross adds and a high amount of disconnects, it's a dangerous place to be in terms of volatility."

Key product announcements:

- Invincible WiFi™ launching in February 2026—Wi-Fi 7 router with battery backup and 5G backup service, seamlessly switched on the same SSID for storms or outages

- $1,000 Savings Guarantee launching in February—if Spectrum can't save customers $1,000 vs. big three telcos on internet + two mobile lines, they'll credit the difference

- T-Mobile Business MVNO launching within 6 months—additional MVNO agreement for business customers alongside existing Verizon partnership

- Network evolution on track—50% of network upgraded to symmetrical/multi-gig by end of 2026, with remaining 50% completing in 2027

Capital Allocation and Cash Flow

2026 EBITDA Guidance: Slight EBITDA growth expected (excluding transition costs), with H1 2026 more challenged than H2 due to one-time benefits in Q1 2025 and political advertising expected in H2 2026.

2026 Capex Guidance: ~$11.4 billion, slightly below 2025's $11.7B. Capex expected to decline materially in 2027-2028 as network evolution completes.

Charter's multi-year capex trajectory (from earnings slide):

- 2025 Actual: $11.7B

- 2026 Estimate: ~$11.4B

- 2027 Estimate: ~$9.5B

- 2028-2029 Estimate: $7.5-8.0B/year

2026 Cash Taxes: Expected $500-800 million, down from ~$900 million in 2025 due to the One Big Beautiful Bill Act.

Since September 2016, Charter has repurchased 179.7 million shares for $78.8 billion at an average price of $438/share.

Balance Sheet and Leverage

Pro forma for the Liberty Broadband transaction, leverage is 4.21x.

Updated Leverage Target: CFO Jessica Fischer announced Charter is moving its post-Cox target leverage to the low end of a new 3.5-3.75x range, down from the previous 3.5-4x midpoint target. The company expects to achieve this within 3 years following the Cox close.

"Lower leverage will drive some impact to our weighted average cost of capital, which should in turn positively affect valuation. It should attract a broader constituency of holders to the stock and open the potential for improved debt ratings, including an investment-grade corporate family rating."

In January 2026, Charter issued $3 billion in new senior notes (7.000% due 2033 and 7.375% due 2036) to refinance near-term maturities.

How Did the Stock React?

Charter shares rose 4.3% in after-hours trading to $199.81 following the earnings release.

This positive reaction came despite the revenue and EPS misses, as investors focused on:

- First video subscriber gain in years

- Stable internet subscriber trends (losses improving)

- Robust mobile growth trajectory

- Strong FY25 free cash flow of $5B

- Clear capex decline path through 2029

The stock remains down significantly from its 52-week high of ~$427, reflecting ongoing concerns about broadband competition from FWA (fixed wireless access) providers and secular video declines.

Pending M&A: Cox and Liberty Broadband

Charter has two major transactions pending:

-

Liberty Broadband Combination - Simplifies corporate structure by merging with Liberty Broadband (LBRDA), Charter's largest shareholder

-

Cox Communications Acquisition - Charter to acquire Cox's cable systems, expanding its footprint. Transition expenses of $15M in Q4 2025 related to integration preparation.

Both deals remain subject to regulatory approval and shareholder votes.

Risks and Concerns

Competition from FWA: T-Mobile and Verizon continue adding fixed wireless subscribers, particularly in suburban markets where Charter competes.

Video economics: Despite subscriber stabilization, video revenue continues declining as customers shift to lower-priced packages with streaming apps. Programming costs remain elevated.

Leverage: At 4.2x net leverage, Charter has limited financial flexibility, particularly if the economic environment deteriorates.

Execution risk on Cox integration: The Cox acquisition adds complexity and integration risk at a time when Charter is still executing its network evolution.

Q&A Highlights

On the amended Verizon MVNO agreement (Craig Moffett, MoffettNathanson): Chris Winfrey confirmed the MVNO agreement was "amended and modernized" but maintained it's a "structural and long-term agreement that underpins everything we're doing." The 5G offload rate has improved to ~89-90%, up from ~88% last quarter and ~85% a few quarters ago—a 20%+ reduction in wholesale network usage.

On Spectrum Mobile brand awareness (Ben Swinburne, Morgan Stanley): Winfrey acknowledged that "Spectrum Mobile is still a relatively new brand in the marketplace" and that getting mobile from your cable provider is "still a relatively new concept." However, he noted most customers don't realize they're connecting to faster Wi-Fi speeds versus 5G when moving around—"we have work to do to really show and demonstrate that product capability."

On fiber competition market share (Vikash Harlalka, New Street Research): Charter has greater penetration than fiber competitors even in mature fiber overlap markets. Winfrey stated: "We really don't see overbuilders reaching their ROI goals within our footprint, now or in the future." Initial overbuild impact is typically limited to a few percentage points of internet penetration during the first year.

On ARPU trends (CFO Jessica Fischer):

- Internet ARPU: Expected to grow in 2026, though more slowly than prior years as Spectrum pricing/packaging rolls out

- Mobile ARPU: Has bottomed out—more customers taking Gig product which includes unlimited premium at unlimited pricing

- Video ARPU: Will continue declining due to streaming app allocations, unfavorable bundled revenue allocation, and higher mix of skinnier tiers

On pricing strategy sustainability (Michael Rollins, Citi): About 40% of Charter's footprint has new September 2024 pricing/packaging; expected to reach 60% by end of 2026. The strategy maintains or grows customer relationship ARPU through higher product penetration despite lower broadband pricing.

Forward Catalysts

- Q1 2026 earnings (late April) - First full quarter with new pricing and video packaging

- Invincible WiFi launch - New premium product could drive ARPU

- Network evolution milestones - 2027 completion target for symmetrical speeds

- Cox transaction close - Expected mid-2026 pending regulatory approval

- Liberty Broadband merger completion - Simplifies structure, potential for increased buybacks

- 2028-2029 capex decline - FCF inflection as network build completes

Report generated by Fintool AI Agent on January 30, 2026. Data sourced from Charter Communications SEC filings, press releases, and S&P Global.